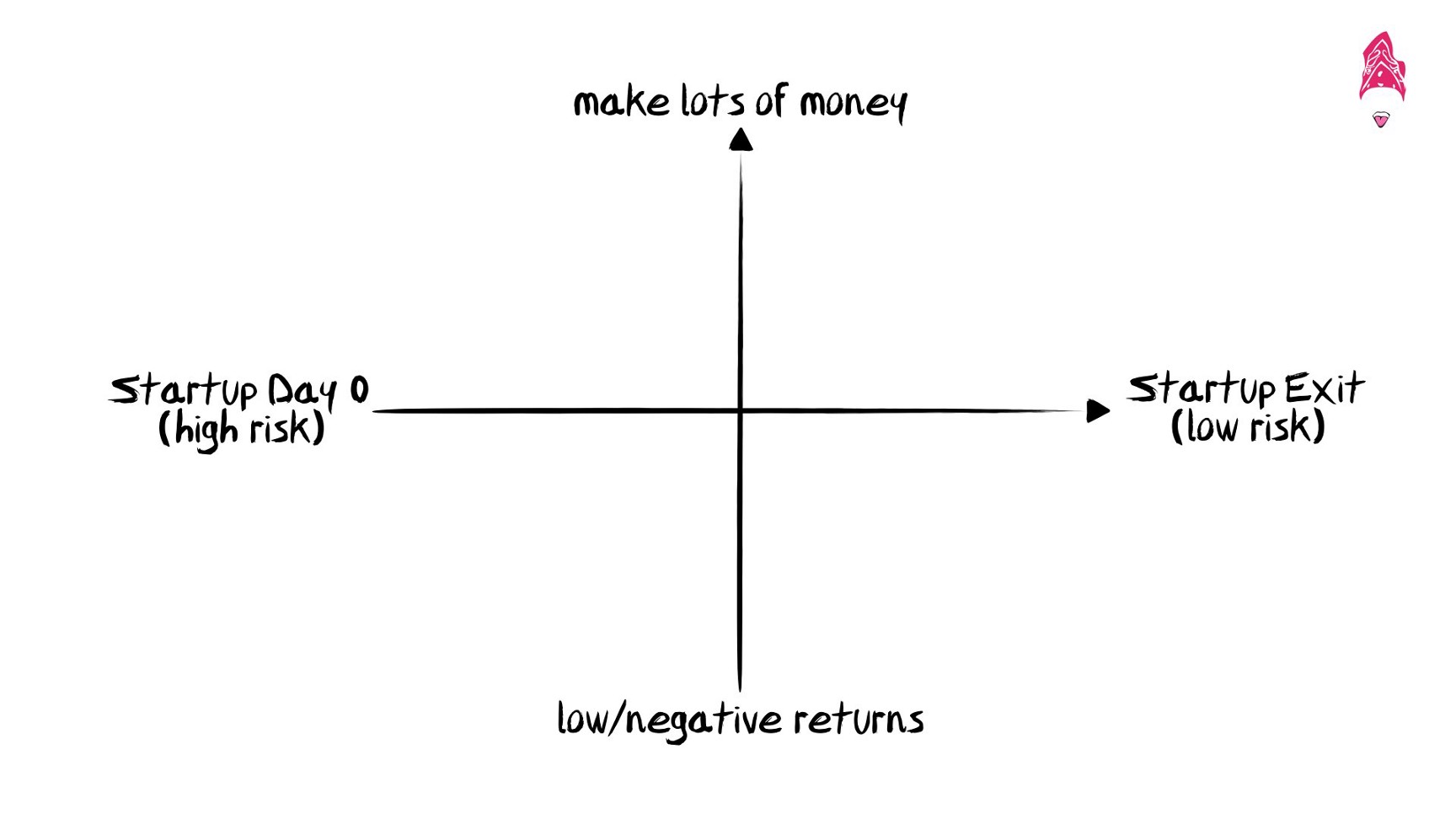

The quadrant of startup investment. Yes, we made this up ourselves.

We humbly posit to you that if you’re an individual looking to start diversifying your current investment porftolio by investing in startups, then the only ones worth your time at this stage in the ecosystem will be early-stage (pre-seed or seed) startups.

Besides the fact that investing earlier means better returns (ceteris paribus),you typically wouldn’t be involved past the growth stage unless:

- you know the founders somehow; or

- you’re a prestigious VC; or

- you’re following your pro-rata rights (and even then, the buck eventually stops somewhere)

And if you were someone like that, you wouldn’t be reading this article anyway!

How hungry are you, really?

Here’s an explanation of the framework for how we’re thinking about it.

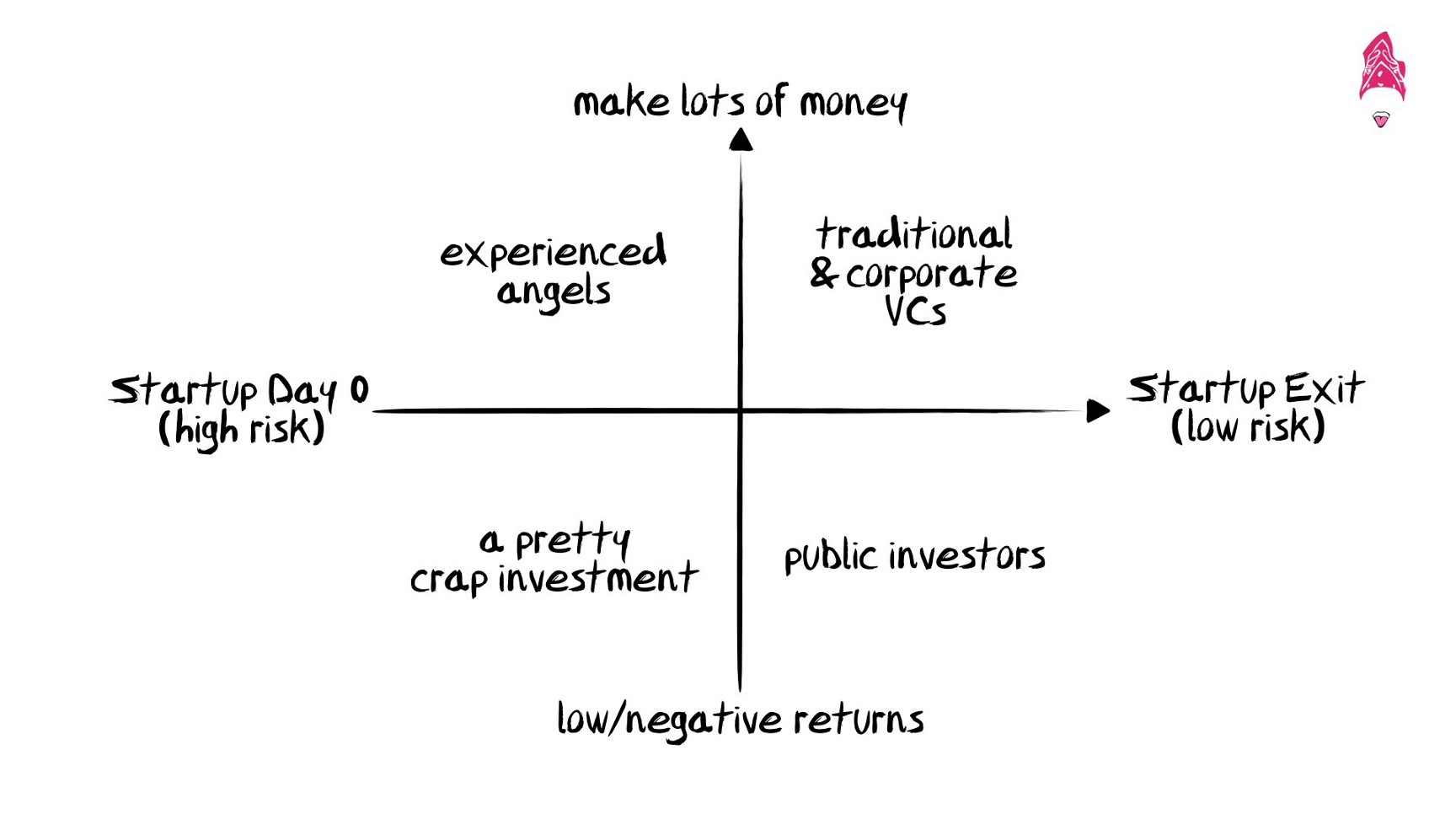

Same investment quadrants as above! Add a comment if you think we can improve this simple framework.

On one end, day 0 for startups, on the other, the day the startup exits and cashes out. High risk to low risk. Remember, when investing in startups, chances are you will lose money. OR, you might just make it big. That’s why startup investors advise you to diversify, diversify, diversify. Even then, capital is at risk, as with all financial investments.

Having said all that, here’s where different folks invest. Each type of investor has a different risk appetite, and general expectation of return on investment. Investment decisions are also made on the basis of other factors, including but not limited to amount of investable capital and access to deal flow and other resources (time, skills relevant to the startup). We haven’t even gotten started on the actual deals, the startups themselves (although we will, next week)!

TL;DR, how you want to play determines how (and if) you spray and pray.

We’ve filled up our shiny, probably-oversimplified-for-the-purposes-of-discussion, new quadrant thingy with the folks we think will typically play in each.

Before you scroll further down, how hungry are you feeling right now?

But, but, there’s a new startup popping up every milisecond!

By virtue of the startups being early-stage, there are quite a lot of them. And not everybody has the resources to dedicate to the initial due diligence required. And unless you’re already in the startup ecosystem, or have access to the grapevine, you won’t be able to shop retail as an individual, that is to say, have access to startup teams and ideas worth investing in in the first place.

Finding startups is easy, finding ones worth your time + money => harder than you might think.

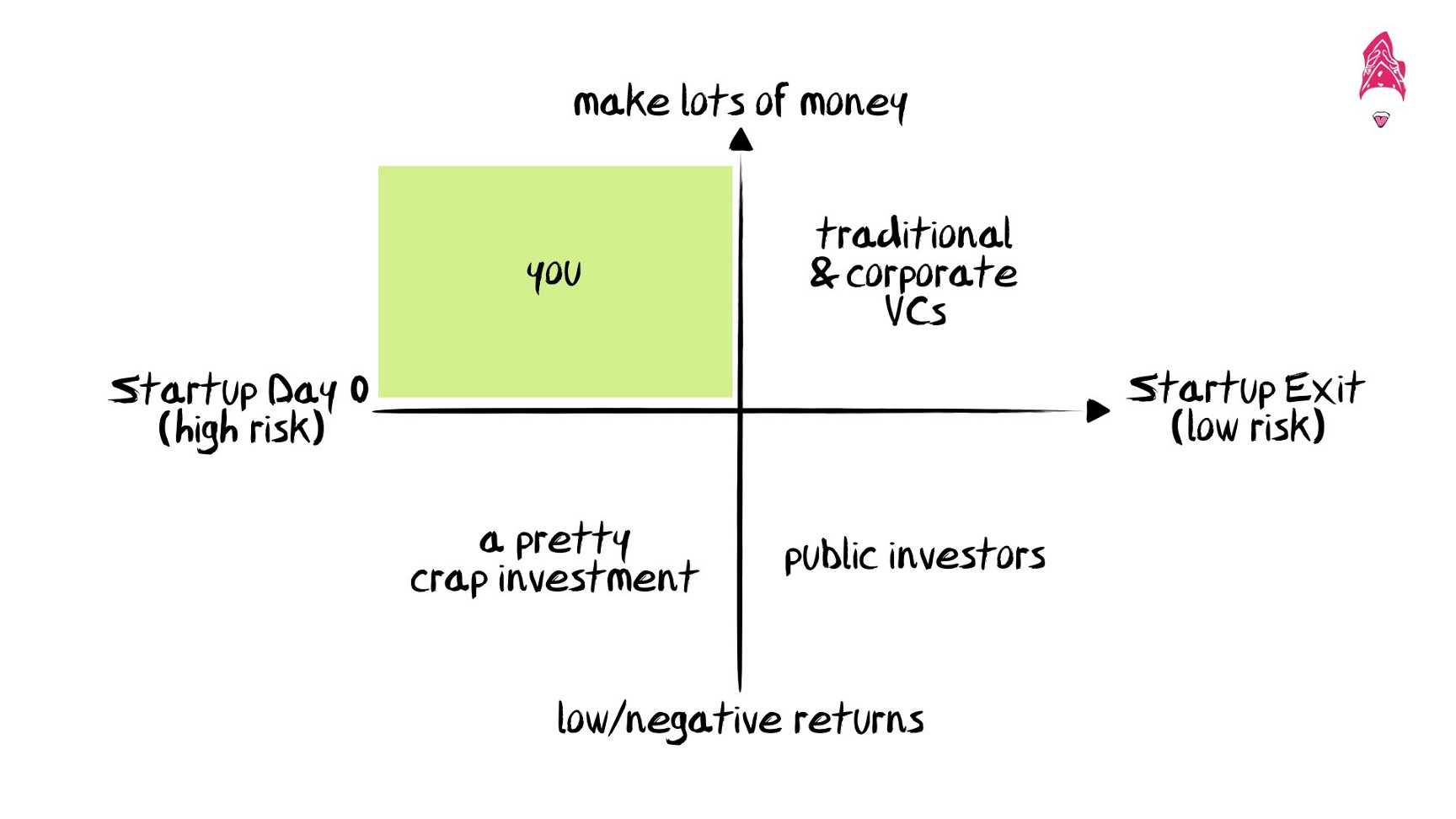

So here’s where we think you can, and should play.

With us. :D

78 words on why.

Investing alongside an experienced angel derisks the process for you (mandatory warning: still doesn’t mean you should go in with your eyes closed!). An experienced angel who decides to lead an investment generally does a lot of the groundwork for a deal, and before platforms like AngelList, which we use to syndicate our own deals; you would probably never be able to get in on the action unless you knew the angel or startup founder in question personally.

Bonus: If you do happen to be a UK-taxpaying investor, then HMRC tax relief schemes like SEIS and EIS make the deal even sweeter for you (play with startups! pay less tax!).

If you skimmed this article…

… early-stage is the way to go for the returns, but only if you personally have a way of handling deal flow and due diligence, or if you co-invest with an experienced startup investor who will take on the brunt of that work, mitigating your own risk and allowing you access to startup teams you might not have been able to invest in otherwise. :)

Doug

Connect and follow me: