Angellist gets $400 million what does Naval do after buying a new sweater?

This is serious news on the investing front.

Incase you did not know Angellist allows angel investors and their friends and followers to invest in companies via a platform. In Europe I have been by far the most active syndicate on Angellist so I should know a bit about it, the good and the bad:)

As and angel investor I kept doing all the crap stuff so that my mates could them invest in deals I found and sourced and romanced and did legals for etc etc etc. Simply as they were mates and the startup needed more cash than I had. As time rolled on I started getting bored of this…..I do all the work and my mates get the upside….they said thanks etc….but if I was going to be serious about doing this investing lark this was not the way to do it, as it was just too painful with no upside.

So a year ago I hear about Angellist and join up, quickly I get backers ( over 170 of them now, plus we now have 3 syndicates doing deals ).

Here is another plug, it is a genius idea:)

Foreign investing – Click Here

People who think women make better founders – Click Here

Thus it should all be rosie in the garden, except there are issues and the main ones are:

- the 170 backers many do not know what they are doing, or how to do an investment or how how Angellist works.

- every deal people are having to walk people almost by hand how to do the investment

- we have no idea how much people will invest, as hence cannot know what amount we can agree to invest with any startup we wish to back

This is not how I thought it would work and I am sure not how Naval thought it would, but when you are creating something new there are growing pains. The Angellist people have had their fair share of me moaning at them about things:)

NOW HOW DOES THE WORLD LOOK

So the $400 million becomes very interesting as it will put cash in the system hence meaning angels can go and find deals and put them on the platform knowing the money will come and be quicker and easier, from more sophisticated investors, who are effectively betting on the early stage tech index. This is the same idea that DST with YCombinator in 2011 and people thought was madness.

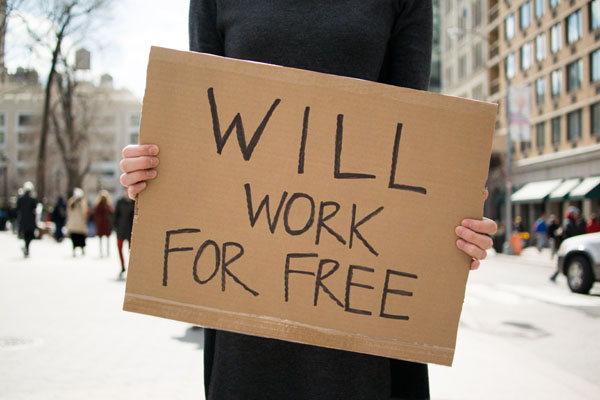

For CSC ( a $12 billion Chinese private equity fund ) I think it is a hugely smart move. Angellist has some of the smartest and best connected angel investors in the world on the platform all looking for deals with no management fee. So CSC has now become an LP in a very good VC with lots of very good General Partners who are all working for free…genius.

Some simple maths for you:

$400 million invested in normal VC fund

2% management fees for first 5 years and then 1% management fees for 5 years = 15% management fees

15% of $400 million = $60 million saving in fees

But the real genius is the “General Partners”, ie moi, are also investing their cash and their friends cash in the deal, hence are much more aligned with the LP than a normal GP of a traditional VC would be.

So now I am a General Partner ( manager/employee ) and a minor Limited Partner ( small investor ) in a psuedo CSC Venture Capital fund, and I am not being paid to do any of the work. to find deals for them. Even worse they will not guarantee to back me or any Angellist syndicate. Does this actually help my syndicate? Lets look at the main issue once again, the problems currently with Angellist as mentioned before:

- the 170 backers many do not know what they are doing, or how to do an investment or how how Angellist works.

- every deal people are having to walk people almost by hand how to do the investment

- we have no idea how much people will invest, as hence cannot know what amount we can agree to invest with any startup we wish to back.

So will the CSC $400 million actually fix this issue?? Yes if they are going to blanket cover every syndicate on Angellist with a guaranteed amount of money or maybe a % of the money needed? No if they are going to be selective on which deals they will back as this will not fix the money liquidity issues with Angellist.

Doug

Doug